Understanding BMO Auto Loan Payment Options: A Comprehensive Guide to Financing Your Vehicle

Guide or Summary:BMO Auto Loan Payment OverviewBenefits of Choosing BMO for Your Auto LoanUnderstanding Your Monthly PaymentsInterest Rates and How They Aff……

Guide or Summary:

- BMO Auto Loan Payment Overview

- Benefits of Choosing BMO for Your Auto Loan

- Understanding Your Monthly Payments

- Interest Rates and How They Affect Your Payments

- Payment Options and Flexibility

- Tips for Managing Your BMO Auto Loan Payment

**Translation of "BMO Auto Loan Payment": BMO汽车贷款支付**

---

BMO Auto Loan Payment Overview

When considering financing options for purchasing a vehicle, understanding the intricacies of the BMO Auto Loan Payment process is crucial. BMO, or the Bank of Montreal, offers various auto loan products tailored to meet the diverse needs of car buyers. Whether you are looking to purchase a new or used vehicle, BMO provides competitive rates and flexible payment plans that can help you manage your budget effectively.

Benefits of Choosing BMO for Your Auto Loan

One of the primary advantages of selecting BMO for your auto loan is their commitment to customer service and support. From the initial application process to the final payment, BMO representatives are available to guide you through each step. Additionally, BMO offers a straightforward online application process, allowing you to apply for an auto loan from the comfort of your home. Once approved, you can access tools that help you calculate your monthly payments, ensuring you fully understand your financial commitments.

Understanding Your Monthly Payments

The BMO Auto Loan Payment structure is designed to be transparent. Your monthly payments will depend on several factors, including the loan amount, interest rate, and loan term. BMO provides a variety of loan terms, typically ranging from 24 to 84 months, allowing you to choose a repayment schedule that aligns with your financial situation. It's important to note that a longer loan term may result in lower monthly payments but could lead to paying more interest over the life of the loan.

Interest Rates and How They Affect Your Payments

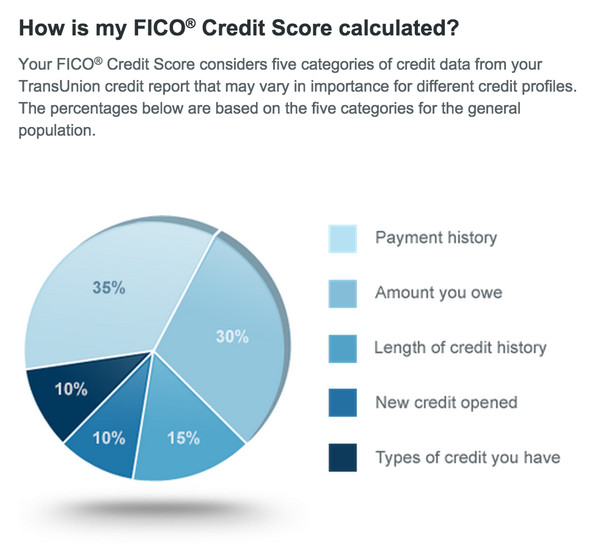

Interest rates play a significant role in determining your BMO Auto Loan Payment. BMO offers competitive rates that can vary based on your credit score, the type of vehicle, and the length of the loan. A higher credit score often translates to lower interest rates, which can significantly reduce your overall payment amount. It's advisable to check your credit score before applying for an auto loan to better understand what rates you might qualify for.

Payment Options and Flexibility

BMO understands that financial circumstances can change, and they offer various payment options to accommodate your needs. You can set up automatic payments, which can help you avoid late fees and keep your credit score intact. Additionally, if you find yourself in a difficult financial position, BMO may provide options for payment deferral or restructuring your loan to make payments more manageable.

Tips for Managing Your BMO Auto Loan Payment

To ensure that you stay on top of your BMO Auto Loan Payment, consider creating a budget that includes your monthly car payment, insurance, fuel, and maintenance costs. This holistic approach to budgeting will help you avoid any surprises and keep your finances in check. Utilizing BMO's online banking tools can also help you track your payments and manage your loan effectively.

In summary, understanding the BMO Auto Loan Payment process is essential for anyone looking to finance a vehicle. With competitive rates, flexible payment options, and excellent customer support, BMO stands out as a reliable choice for auto financing. By taking the time to research and plan your auto loan, you can make informed decisions that will benefit your financial future. Whether you are a first-time buyer or looking to refinance, BMO is equipped to meet your auto loan needs and help you drive away in your dream car.