Understanding the Increase in Conforming Loan Limits: What It Means for Homebuyers and the Housing Market

#### Increase in Conforming Loan LimitsThe term **increase in conforming loan limits** refers to the adjustment of the maximum loan amounts that can be acqu……

#### Increase in Conforming Loan Limits

The term **increase in conforming loan limits** refers to the adjustment of the maximum loan amounts that can be acquired through government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac. These limits are crucial because they determine how much money homebuyers can borrow while still benefiting from lower interest rates and favorable loan terms. As housing prices rise across the United States, the **increase in conforming loan limits** is a significant development that affects various stakeholders in the real estate market.

#### What Are Conforming Loans?

Conforming loans are mortgage loans that meet the underwriting guidelines set by Fannie Mae and Freddie Mac. These loans are designed to be sold to the GSEs in the secondary mortgage market, which helps to ensure liquidity and stability in the housing market. The conforming loan limits are updated annually based on changes in the housing market, particularly the median home prices in different regions.

#### Impact of the Increase in Conforming Loan Limits

The **increase in conforming loan limits** has several implications for homebuyers, lenders, and the overall housing market:

1. **Access to More Financing Options**: With higher loan limits, homebuyers can secure larger loans without having to resort to non-conforming loans, which usually come with higher interest rates and stricter underwriting criteria.

2. **Affordability in High-Cost Areas**: In metropolitan areas where housing prices have surged, the **increase in conforming loan limits** allows buyers to purchase homes that were previously out of reach. This is particularly beneficial for first-time homebuyers and those looking to upgrade to larger homes.

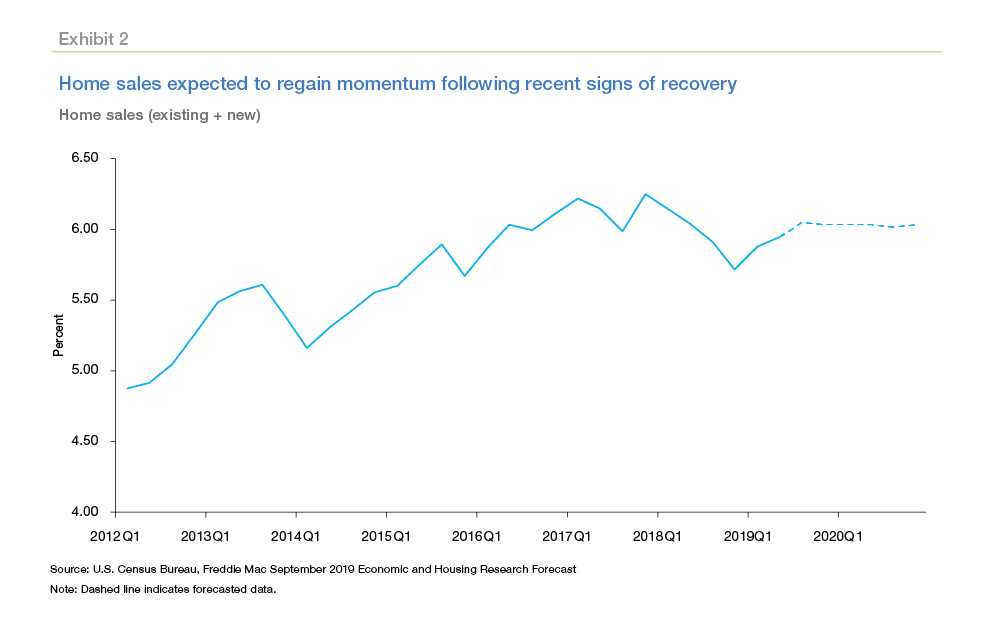

3. **Market Stability**: By increasing the conforming loan limits, the government can help stabilize the housing market. When buyers have access to affordable financing, it can lead to increased demand for homes, which in turn supports home prices and encourages new construction.

4. **Impact on Mortgage Rates**: Conforming loans often come with lower mortgage rates compared to non-conforming loans. An increase in conforming loan limits can lead to more competition among lenders, potentially driving down rates even further for borrowers.

#### Conclusion

The **increase in conforming loan limits** is a significant factor that can reshape the landscape of the housing market. It opens up new possibilities for homebuyers, especially in regions where home prices have escalated. As we move forward, it will be essential for prospective buyers to stay informed about these changes and understand how they can leverage the new limits to achieve their homeownership goals.

In summary, the **increase in conforming loan limits** not only benefits individual borrowers but also contributes to a more robust and accessible housing market. As this trend continues, it will be interesting to observe how it influences buyer behavior, lending practices, and overall market dynamics in the coming years.