"Unlock Your Dream Home: How a Loan Officer TX Can Guide You Through the Mortgage Process"

#### Understanding the Role of a Loan Officer TXA Loan Officer TX plays a crucial role in the home buying process, acting as a bridge between you and the fi……

#### Understanding the Role of a Loan Officer TX

A Loan Officer TX plays a crucial role in the home buying process, acting as a bridge between you and the financial institutions that provide mortgage loans. They are professionals who specialize in evaluating, authorizing, or recommending approval of loan applications for individuals and businesses. Their expertise is vital for navigating the often-complex world of mortgages, especially for first-time homebuyers.

#### The Importance of Choosing the Right Loan Officer TX

Selecting the right Loan Officer TX can make a significant difference in your home buying experience. A knowledgeable loan officer will not only help you understand your financing options but will also tailor a loan package that fits your unique financial situation. This personalized approach can save you time and money in the long run.

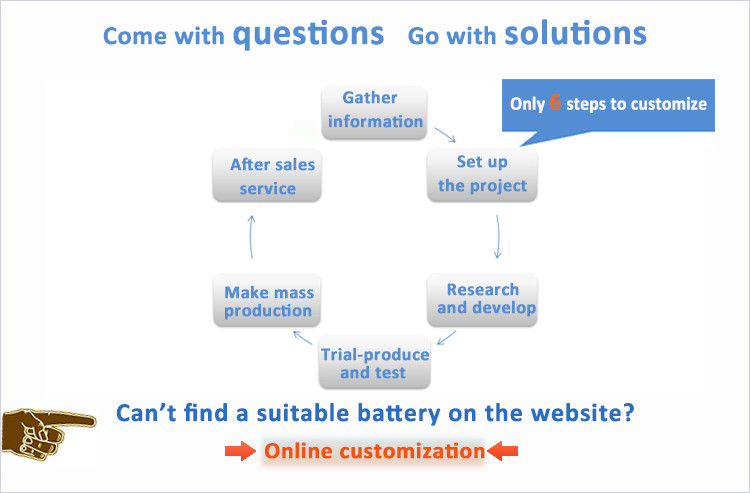

#### Steps to Work with a Loan Officer TX

1. **Initial Consultation**: The first step is to meet with your Loan Officer TX for an initial consultation. During this meeting, you will discuss your financial situation, credit history, and what you are looking for in a home.

2. **Pre-Approval Process**: Your loan officer will help you get pre-approved for a mortgage, which involves submitting your financial documents and having your credit checked. This step is crucial as it gives you a clear understanding of how much you can afford.

3. **Loan Options**: Once pre-approved, your Loan Officer TX will present you with various loan options. They will explain the differences between fixed-rate and adjustable-rate mortgages, as well as other financing options like FHA or VA loans.

4. **Application Submission**: After selecting the best loan option for you, your loan officer will assist in submitting the application to the lender. They will ensure that all necessary documents are completed and submitted correctly.

5. **Closing the Deal**: Finally, your Loan Officer TX will guide you through the closing process, ensuring that all paperwork is in order and that you understand the terms of your mortgage agreement.

#### Benefits of Working with a Loan Officer TX

- **Expert Guidance**: A Loan Officer TX has extensive knowledge of the local real estate market and mortgage products. They can provide insights that you might not find on your own.

- **Personalized Service**: Unlike online mortgage applications, working with a loan officer offers you personalized service. They will take the time to understand your needs and preferences.

- **Time-Saving**: The mortgage process can be time-consuming and overwhelming. A loan officer streamlines this process, allowing you to focus on finding your dream home.

- **Negotiation Skills**: Experienced loan officers have strong negotiation skills, which can help you secure better terms on your mortgage.

#### Conclusion: Your Path to Homeownership with a Loan Officer TX

In summary, a Loan Officer TX is an invaluable resource for anyone looking to purchase a home. Their expertise can simplify the mortgage process, ensuring that you make informed decisions every step of the way. Whether you are a first-time homebuyer or looking to refinance, partnering with a knowledgeable loan officer can help you achieve your homeownership goals with confidence. Don't hesitate to reach out to a Loan Officer TX today and take the first step towards unlocking the door to your dream home!