"Exploring the Benefits and Opportunities of an Online Payday Loan Franchise"

#### Online Payday Loan FranchiseIn recent years, the financial landscape has evolved significantly, leading to the rise of various lending options. One suc……

#### Online Payday Loan Franchise

In recent years, the financial landscape has evolved significantly, leading to the rise of various lending options. One such option that has gained immense popularity is the online payday loan franchise. This business model not only offers a lucrative opportunity for entrepreneurs but also provides essential financial services to individuals in need. In this article, we will delve into the intricacies of the online payday loan franchise, its benefits, and the opportunities it presents for aspiring business owners.

#### Understanding the Concept of an Online Payday Loan Franchise

An online payday loan franchise operates under a proven business model that allows franchisees to offer payday loans to consumers through an online platform. This type of franchise leverages technology to streamline the loan application process, making it more accessible and convenient for borrowers. The franchisee benefits from an established brand, operational support, and a comprehensive system that simplifies the lending process.

#### The Benefits of an Online Payday Loan Franchise

1. **Low Startup Costs**: Compared to traditional brick-and-mortar businesses, an online payday loan franchise typically requires lower initial investment. This makes it an attractive option for entrepreneurs looking to enter the financial services sector without substantial capital.

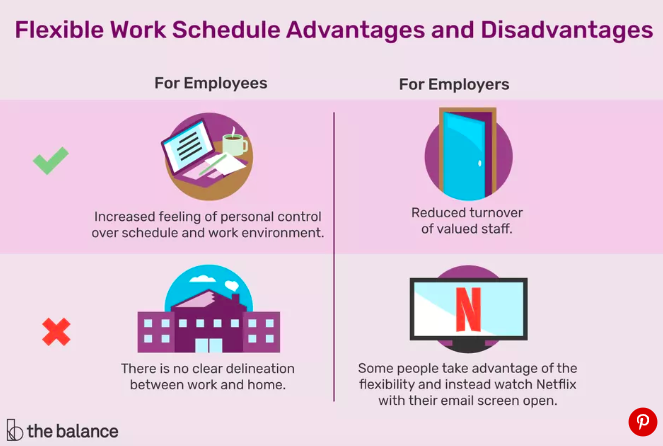

2. **Flexibility and Convenience**: The online nature of this franchise allows franchisees to operate from virtually anywhere, providing flexibility in managing their business. This is particularly advantageous for those who prefer a work-from-home setup.

3. **High Demand for Short-Term Loans**: With the increasing number of individuals seeking quick financial solutions, the demand for payday loans continues to rise. An online payday loan franchise positions itself to capitalize on this growing market.

4. **Comprehensive Training and Support**: Franchise owners benefit from training programs and ongoing support from the franchisor. This ensures that they are well-equipped to navigate the complexities of the lending industry and adhere to regulations.

5. **Established Brand Recognition**: Partnering with a reputable franchise brand provides immediate credibility in the marketplace. This can significantly enhance customer trust and lead to higher loan acquisition rates.

#### Opportunities for Growth in the Online Payday Loan Franchise

The landscape of online payday loans is constantly evolving, offering numerous opportunities for growth. Franchisees can expand their services by incorporating additional financial products, such as installment loans or credit repair services. Furthermore, leveraging digital marketing strategies can help attract a broader customer base, ultimately increasing revenue.

#### Challenges to Consider

While the prospects of an online payday loan franchise are promising, it is essential to be aware of potential challenges. Regulatory compliance is a significant concern in the payday loan industry, as laws can vary widely by state or country. Franchisees must stay informed about these regulations to avoid legal pitfalls. Additionally, managing customer relationships and maintaining a positive reputation are critical for long-term success.

#### Conclusion

In summary, an online payday loan franchise presents a unique opportunity for entrepreneurs seeking to enter the financial services industry. With low startup costs, high demand, and the backing of an established brand, this business model offers a pathway to success. However, it is crucial to navigate the challenges associated with regulatory compliance and customer management effectively. By doing so, franchisees can build a thriving business that meets the financial needs of consumers while achieving their entrepreneurial goals.