"Step-by-Step Guide on How to Apply for an Online Loan: Your Ultimate Resource"

#### Understanding Online LoansApplying for a loan has always been a crucial financial decision, and with the advent of technology, the process has become s……

#### Understanding Online Loans

Applying for a loan has always been a crucial financial decision, and with the advent of technology, the process has become significantly easier. An online loan refers to a loan that you can apply for through the internet, eliminating the need for in-person visits to banks or financial institutions. This convenience has made online loans increasingly popular among borrowers.

#### Why Choose to Apply for an Online Loan?

There are several reasons why individuals prefer to apply for an online loan. First and foremost is the convenience factor. You can apply from the comfort of your home, at any time that suits you. This flexibility is particularly beneficial for those with busy schedules or those who may have difficulty accessing traditional banking services.

Another advantage is the speed of the application process. Many online lenders offer quick approval times, sometimes within minutes, allowing borrowers to receive funds faster than traditional methods. This is particularly useful in emergencies when immediate financial assistance is needed.

#### How to Apply for an Online Loan

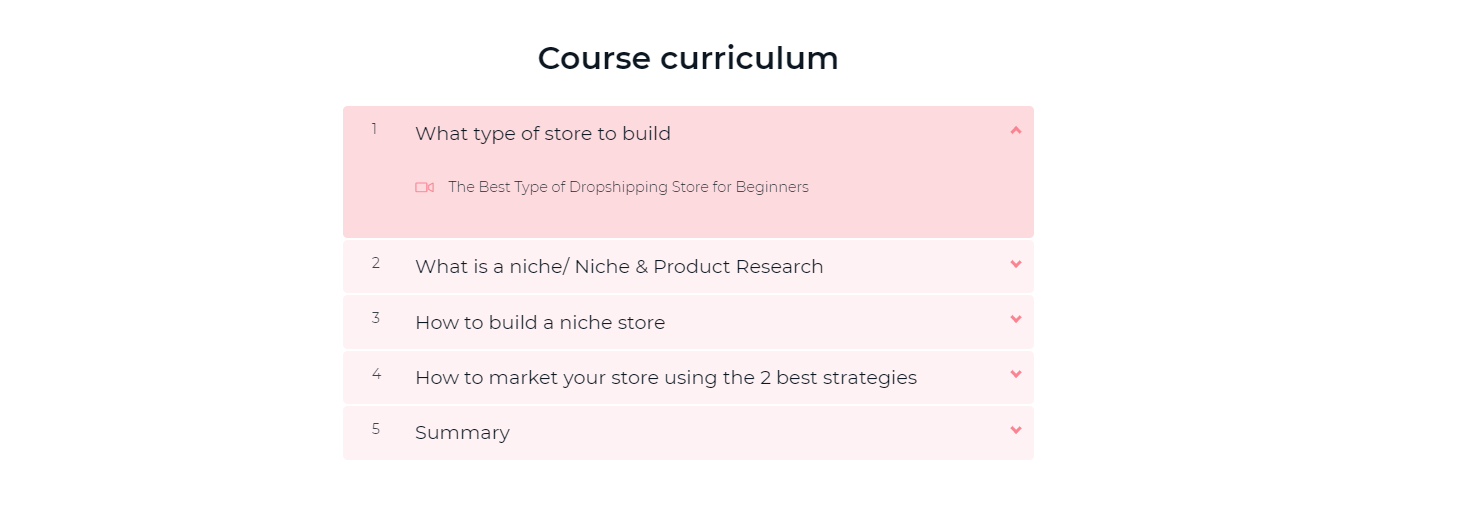

If you're considering applying for an online loan, here are the steps you should follow:

1. **Research Lenders**: Start by researching various online lenders. Look for reviews and ratings to find a reputable lender that meets your needs. Make sure to compare interest rates, fees, and terms.

2. **Check Eligibility**: Before applying, check the eligibility criteria of the lender. This may include factors like credit score, income level, and employment status.

3. **Gather Documentation**: Prepare the necessary documentation, which may include proof of identity, income verification, and bank statements. Having these documents ready can expedite the application process.

4. **Fill Out the Application**: Go to the lender's website and fill out the online application form. Be honest and accurate with the information you provide.

5. **Submit Your Application**: Once you have completed the application form, submit it. You may receive immediate feedback or may have to wait for the lender to review your application.

6. **Review Offers**: If approved, you will receive loan offers. Take the time to review the terms and conditions carefully, including the interest rates and repayment schedules.

7. **Accept the Loan**: If you find an offer that meets your needs, you can accept the loan. The lender will then provide you with the necessary documentation to finalize the agreement.

8. **Receive Funds**: After accepting the loan, the funds will typically be deposited into your bank account within a few business days.

#### Things to Consider Before Applying

Before you proceed to apply for an online loan, it’s essential to consider your financial situation. Assess your ability to repay the loan and ensure that you are not overextending yourself financially. Additionally, be aware of the total cost of the loan, including interest rates and any associated fees.

#### Conclusion

In conclusion, applying for an online loan can be a straightforward and efficient process if you follow the right steps. With the convenience of technology, you can access funds quickly and easily. However, it’s crucial to do your homework and choose a reputable lender while ensuring that you fully understand the terms of your loan. By following this guide, you can navigate the online loan application process with confidence and make informed financial decisions.