Understanding Federal Student Loan Limits by Year: Your Comprehensive Guide

When it comes to financing your education, understanding the federal student loan limits by year is crucial for making informed decisions about borrowing. T……

When it comes to financing your education, understanding the federal student loan limits by year is crucial for making informed decisions about borrowing. These limits dictate how much money you can borrow through federal student loans each academic year, and they vary based on several factors, including your year in school, your dependency status, and the type of loan you are applying for.

In this guide, we will explore the specifics of federal student loan limits by year, providing you with the essential information you need to navigate your financial options effectively.

### What Are Federal Student Loan Limits?

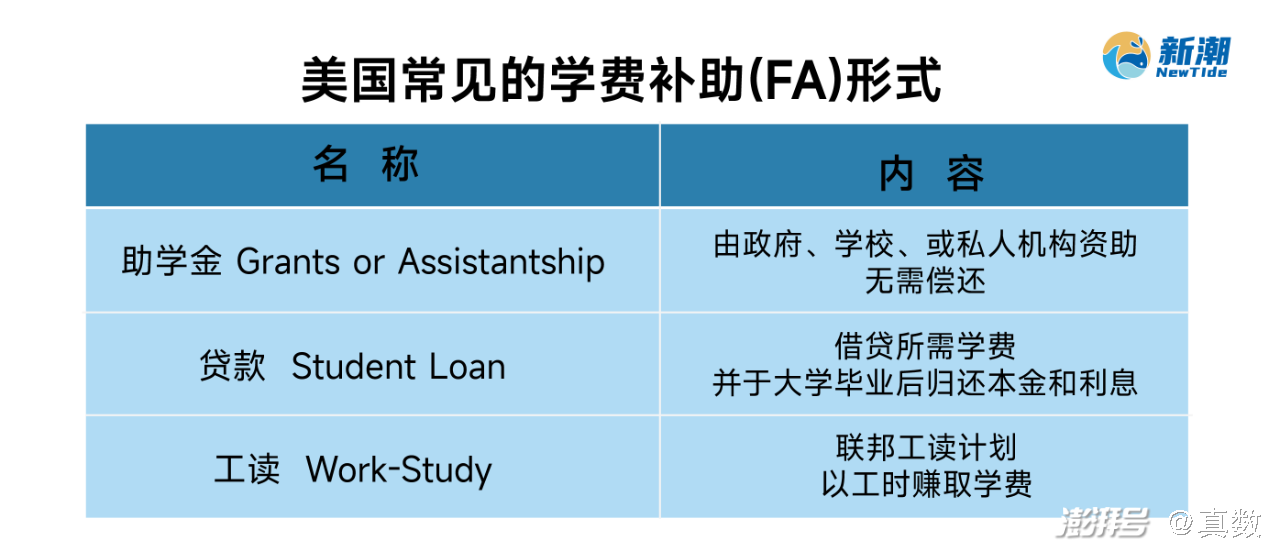

Federal student loan limits are established by the U.S. Department of Education and are designed to ensure that students do not over-borrow while pursuing their education. These limits are divided into two main categories: subsidized and unsubsidized loans. Subsidized loans are available to undergraduate students who demonstrate financial need, while unsubsidized loans are available to both undergraduate and graduate students regardless of financial need.

### Federal Student Loan Limits by Year

The limits for federal student loans vary depending on your academic level and whether you are considered a dependent or independent student. Here’s a breakdown of the federal student loan limits by year:

1. **Freshman Year (0-29 credits completed)**:

- Dependent Students: Up to $5,500 (with a maximum of $3,500 in subsidized loans)

- Independent Students: Up to $9,500 (with a maximum of $3,500 in subsidized loans)

2. **Sophomore Year (30-59 credits completed)**:

- Dependent Students: Up to $6,500 (with a maximum of $4,500 in subsidized loans)

- Independent Students: Up to $10,500 (with a maximum of $4,500 in subsidized loans)

3. **Junior and Senior Years (60 or more credits completed)**:

- Dependent Students: Up to $7,500 (with a maximum of $5,500 in subsidized loans)

- Independent Students: Up to $12,500 (with a maximum of $5,500 in subsidized loans)

4. **Graduate and Professional Students**:

- All Students: Up to $20,500 in unsubsidized loans (no subsidized loans are available for graduate students).

### Aggregate Loan Limits

In addition to annual limits, there are also aggregate loan limits that cap the total amount of federal student loans you can borrow throughout your education. For undergraduate students, the aggregate limit is $31,000 for dependent students (with a maximum of $23,000 in subsidized loans) and $57,500 for independent students (with a maximum of $23,000 in subsidized loans). For graduate students, the aggregate limit is $138,500, which includes any federal loans received for undergraduate study.

### Importance of Understanding Loan Limits

Understanding the federal student loan limits by year is essential for several reasons:

- **Budgeting**: Knowing how much you can borrow helps you plan your budget and manage your finances throughout your education.

- **Avoiding Over-Borrowing**: Being aware of the limits can prevent you from taking on more debt than necessary, which can lead to financial strain after graduation.

- **Making Informed Decisions**: With this knowledge, you can make better choices about which loans to accept and how much to borrow, ensuring that you are financially prepared for your future.

### Conclusion

In summary, the federal student loan limits by year provide a framework for students to understand how much they can borrow to finance their education. By familiarizing yourself with these limits, you can make informed decisions about your financial future and ensure that you are prepared for the responsibilities that come with student loans. Always consider your options carefully, and don’t hesitate to seek guidance from financial aid advisors to help you navigate the complexities of student loans.