How to Secure Medical Loans for Bad Credit: Your Comprehensive Guide

#### Understanding Medical Loans for Bad CreditMedical loans for bad credit are financial products designed to help individuals with poor credit histories c……

#### Understanding Medical Loans for Bad Credit

Medical loans for bad credit are financial products designed to help individuals with poor credit histories cover healthcare expenses. These loans can be crucial for those facing unexpected medical bills, surgeries, or treatments that may not be fully covered by insurance. Unlike traditional loans, medical loans for bad credit often have more lenient approval criteria, making them accessible to a broader range of borrowers.

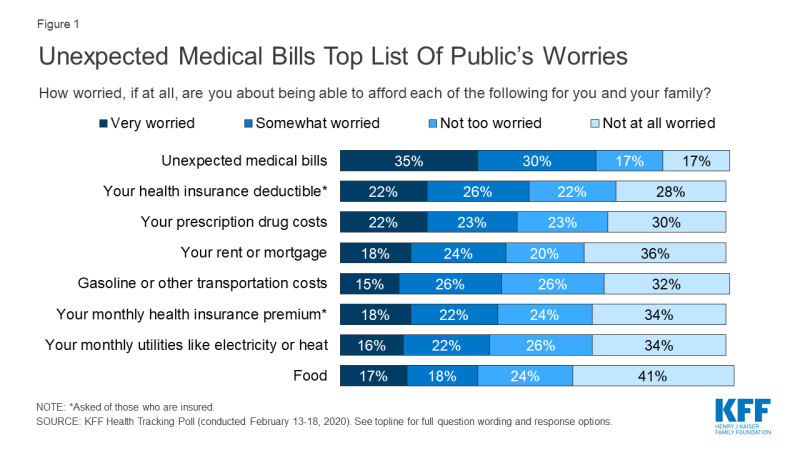

#### The Importance of Medical Loans

Healthcare costs can be overwhelming, especially for individuals without sufficient savings. Medical loans provide a viable solution, allowing patients to receive necessary treatments without the burden of upfront costs. For those with bad credit, these loans can help bridge the gap between immediate healthcare needs and financial limitations.

#### Types of Medical Loans for Bad Credit

There are several types of medical loans available for individuals with bad credit. These include:

1. **Personal Loans**: Unsecured personal loans can be used for medical expenses. While they may come with higher interest rates for those with poor credit, they offer flexibility in repayment terms.

2. **Credit Cards for Medical Expenses**: Some credit cards are specifically designed for medical expenses, offering promotional interest rates or deferred payment options. However, it’s essential to read the fine print to avoid high-interest charges after the promotional period ends.

3. **Medical Financing Plans**: Many healthcare providers offer financing options directly through their offices. These plans often allow patients to pay for services over time, sometimes with little to no interest.

4. **Peer-to-Peer Lending**: This alternative lending model connects borrowers directly with investors. It can be an option for those with bad credit, as the approval process may be more flexible compared to traditional banks.

#### How to Apply for Medical Loans with Bad Credit

Applying for medical loans with bad credit involves several steps:

1. **Assess Your Financial Situation**: Before applying, take a close look at your finances. Determine how much you need to borrow and what you can afford to repay.

2. **Research Lenders**: Not all lenders cater to individuals with bad credit. Look for lenders that specialize in medical loans for bad credit or those that offer personal loans with lenient terms.

3. **Check Your Credit Report**: Obtain a copy of your credit report to understand your credit standing. Address any errors that may negatively impact your score.

4. **Gather Documentation**: Prepare necessary documents such as proof of income, employment verification, and medical bills. This information will help lenders assess your application more efficiently.

5. **Submit Your Application**: Apply online or in person, depending on the lender’s process. Be honest about your credit situation and provide all required information.

#### Tips for Improving Your Chances of Approval

While securing medical loans for bad credit can be challenging, there are ways to improve your chances of approval:

- **Consider a Co-Signer**: If possible, find someone with good credit who is willing to co-sign your loan. This can significantly increase your chances of approval and may result in better loan terms.

- **Show Proof of Income**: Demonstrating a stable income can reassure lenders of your ability to repay the loan, even if your credit score is low.

- **Explore Local Credit Unions**: Credit unions often have more flexible lending criteria compared to traditional banks. They may offer lower interest rates and better terms for borrowers with bad credit.

#### Conclusion

Medical loans for bad credit can provide essential financial support for those facing medical expenses. By understanding the types of loans available, the application process, and strategies to improve approval chances, individuals can take control of their healthcare costs. Always remember to read the terms carefully and choose a loan that fits your financial situation to avoid further debt.